Paying off a Texas title loan requires understanding terms and implementing structured monthly payments to avoid default risks. Comparing it with traditional banking loans shows higher rates and asset loss potential with titles but quicker access. Exploring alternatives like refinancing or non-profit guidance offers better long-term repayment options and financial stability for Texas title loan payoff strategy.

In the competitive landscape of lending, understanding the unique aspects of a Texas title loan payoff strategy is crucial. This article delves into the intricacies of this specialized debt solution, providing insights into how it compares to traditional banking loans. We explore alternative options for debt settlement, empowering folks to make informed decisions. By examining the Texas title loan payoff process and its advantages and disadvantages, you’ll gain a comprehensive view that could revolutionize your financial trajectory.

- Understanding Texas Title Loan Payoff Process

- Comparison: Title Loans vs Traditional Banking Loans

- Exploring Alternative Options for Debt Settlement

Understanding Texas Title Loan Payoff Process

Paying off a Texas title loan requires a structured approach to ensure repayment without additional fees or penalties. The process typically begins with the borrower understanding the loan terms, including interest rates and repayment schedules. Lenders in Texas offer flexible payments, allowing borrowers to pay back the loan over an extended period, which can be beneficial for those needing quick funding for emergency funds or other financial emergencies.

The payoff strategy often involves regular monthly installments until the full amount is settled. Borrowers should keep track of their payments and ensure timely deposits to avoid default. Early repayment is also an option, which can save on interest charges. This method provides a clear path to financial recovery, especially for those seeking alternatives to traditional banking options for emergency funding.

Comparison: Title Loans vs Traditional Banking Loans

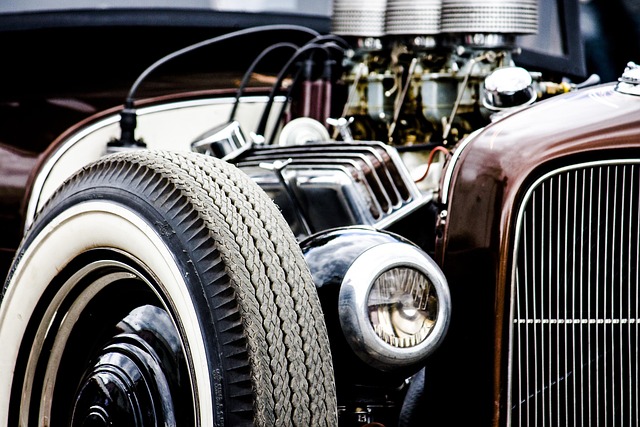

When considering a Texas title loan payoff strategy, it’s beneficial to understand how it stacks up against traditional banking loans. Unlike semi truck loans or other forms of financing that require extensive paperwork and strict credit checks, Texas title loans operate on a simpler principle. With a title loan, borrowers use their vehicle ownership as collateral, which means the lender has a clear legal claim to the vehicle’s title if the loan isn’t repaid. This process, while straightforward, can be appealing for those with limited credit history or immediate financial needs, as it offers faster access to funds based on the vehicle’s valuation.

However, this convenience comes at a cost. Interest rates for Texas title loans are generally higher compared to traditional banking loans, and the lender may charge fees for early payoff. Additionally, if the borrower defaults, they risk losing their vehicle—a significant financial blow that can impact their ability to maintain transportation and mobility. In contrast, traditional banking loans often offer more flexible repayment terms, lower interest rates, and no risk of losing a valuable asset, making them a preferred choice for those seeking long-term financial stability and management.

Exploring Alternative Options for Debt Settlement

When considering a Texas title loan payoff strategy, it’s wise to explore alternative debt settlement options available in San Antonio and beyond. While title loans offer quick access to cash, they often come with high-interest rates and short repayment terms, making them a potentially costly choice for borrowers. Luckily, there are several alternatives to consider that could provide more favorable terms and lower interest rates.

One option is loan refinancing, which involves taking out a new loan to pay off an existing one. This can help lower monthly payments and reduce overall interest paid over the life of the loan. Motorcycle title loans, for instance, often have different terms and rate structures that could be more beneficial than traditional title loans. Additionally, working with a financial advisor or non-profit credit counseling agency can provide guidance on managing debt and exploring options tailored to individual circumstances, such as consolidation loans or negotiated settlements with creditors.

When considering a Texas title loan payoff strategy, it’s crucial to weigh its unique characteristics against traditional banking loans and explore alternative debt settlement options. While title loans offer quick access to cash, they come with higher interest rates and repossession risks. Comparing these factors is essential for making an informed decision that aligns with your financial goals and minimizes long-term costs. By exploring alternative methods like debt consolidation or negotiating with lenders, you might find more favorable terms for repaying your loan and avoiding potential pitfalls of a title loan payoff.